The Account Payable turnover ratio is a pivotal financial metric that plays a significant role in running a successful business. It’s crucial for maintaining a healthy cash flow and ensuring your company’s financial well-being. This ratio measures how efficiently your business clears it’s accounts payable within a specific timeframe. In this comprehensive guide, you’ll discover the steps to calculate the AP turnover ratio, gain insights into what it reveals about your business, and explore strategies to enhance it. Furthermore, we’ll delve into best practices for effective working capital management.

Table of Contents

What is AP Turnover Ratio?

The Accounts Payable Turnover Ratio, often referred to as the payable’s turnover or creditor’s turnover ratio, is a crucial liquidity metric that assesses how promptly a business settles its obligations to creditors and suppliers who extend lines of credit. This ratio is determined by calculating the average frequency with which a company pays off its accounts payable balances within a specified accounting period. Found on a company’s balance sheet, the accounts payable turnover ratio holds a pivotal role in evaluating its liquidity and cash flow management.

Calculating the Accounts Payable Turnover Ratio

The regular accounts payable turnover ratio varies by industry, but a ratio between 4 and 6 is typically considered healthy. Anything significantly above or below this range may warrant further examination.

Calculating the AP turnover ratio is a fundamental aspect of keeping your business's financial health in check. To calculate this ratio, you divide the total amount of credit sales by the average accounts payable balance. To calculate the Accounts Payable Turnover Ratio, you can use the following formula:

Accounts Payable Turnover Ratio = COGS/ Average Accounts Payable balance

COGS:

Is the total cost related to producing or procuring goods sold during a period.

Average Accounts Payable:

Represents the mean amount owed to suppliers in the same timeframe.

Example of Accounts Payable Turnover Ratio

Suppose your business made $100,000 in credit purchases and maintained an average AP balance of $20,000 during a specific period. In this case, your AP turnover ratio would be 5 ($100,000 / $20,000), indicating that your business efficiently settles its bills.

$100,000 / $20,000 = $5

It's important to recognize that the ideal AP turnover rate can vary by industry and individual business goals. There isn't a one-size-fits-all solution; instead, your approach should align with your specific objectives and financial situation.

What AP Turnover Ratio Reveals About Your Business?

Ideally, a high accounts payable turnover ratio is preferred. It indicates that your business pays off its creditors rapidly, which can be a sign of financial stability. However, a balance is necessary to maintain good relationships with suppliers. A low ratio might indicate that you are not using your resources effectively.

| Aspect of AP Turnover Ratio | High AP Turnover Ratio | Low AP Turnover Ratio |

|---|---|---|

| Interpretation | Indicates prompt payment of invoices | Suggests delayed bill payments, potentially causing cash flow strain |

| Benefits | Increases cash availability, takes advantage of early payment discounts, and enhances supplier and creditor relations | Discourages suppliers from extending lines of credit, may signal financial challenges |

| Credit Rating | Improves credit rating, showcasing financial management prowess | May affect credit rating negatively, especially if prolonged payment delays persist |

| Suitability by Industry | Optimal for businesses aiming to build or repair their credit | Applicable for businesses with specific financial challenges |

AP Turnover vs AR Turnover Ratios

A side-by-side comparison of the Accounts Payable and Accounts Receivable Turnover Ratio, highlighting their differences and respective importance in financial analysis.

Accounts Payable Turnover Ratio

The Accounts Payable Turnover Ratio gauges how frequently a company pays its suppliers within a specific period.

Excessively high ratios, significantly deviating from industry norms, may strain cash resources, while lower ratios can indicate strategic cash flow management.

This ratio plays a crucial role in balancing timely payments with maintaining a healthy cash position.

Accounts Receivable Turnover Ratio

AR Turnover Ratio evaluates the efficiency of a company's payment collection process from its customers.

A low AR turnover ratio may signal inefficient collection processes, overly lenient credit terms, or doubts regarding customer creditworthiness.

- This ratio is pivotal for assessing a company’s credit policies and the efficiency of its accounts receivable management, influencing cash flow and financial stability.

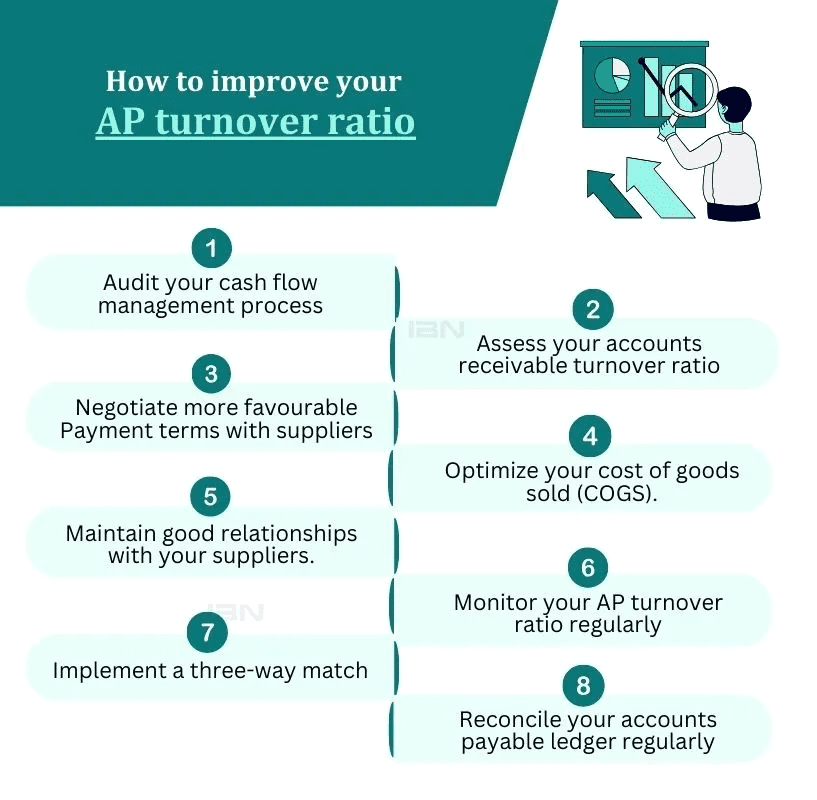

How to improve your AP turnover ratio

A healthy accounts payable turnover ratio can boost your business's financial well-being and strengthen supplier relationships. Here are some tips for improving your AP turnover ratio:

Audit your cash flow management process

Identify areas where you can reduce days payable outstanding (DPO). This may involve streamlining invoice approval workflows, negotiating longer payment terms with suppliers, or automating your AP system.

Assess your accounts receivable turnover ratio

Assess your accounts receivable turnover ratio. If you have a low accounts receivable turnover ratio, it may indicate that you are not collecting payments from customers quickly enough. This can impact your ability to pay suppliers on time

Negotiate more favourable payment terms with suppliers

If you have a good relationship with your suppliers, they may be willing to offer you longer payment terms or early payment discounts.

Optimize your cost of goods sold (COGS).

). By reducing your COGS, you will need to purchase less inventory on credit, which can improve your AP turnover ratio.

Maintain good relationships with your suppliers.

This can make them more willing to negotiate favourable payment terms.

Monitor your AP turnover ratio regularly.

It will help you pinpoint areas that could be enhanced.

The three-way match involves matching invoices to purchase orders and receiving reports to ensure that all payments are accurate

Account payable ledger helps you identify discrepancies and ensure that your records are accurate.

Conclusion

The Accounts Payable Turnover Ratio stands as a critical financial metric for evaluating your company’s financial well-being. Enhancing your control over working capital, cash flow, and real-time liability tracking becomes achievable through the implementation of automated systems and optimizing the AP turnover rate. To further elevate your financial operations, you can explore industry-recognized outsourced finance and accounting services, such as IBN Tech, which supports end-to-end accounting functions. Whether your business is a small enterprise or a larger corporation, comprehending and harnessing the power of the AP turnover ratio can be the key to fostering growth and financial prosperity.

AR Turnover Ratio FAQs

- Q.1 What indicates a good accounts payable turnover ratio?

-

A higher ratio typically suggests effective management, prompt payments, and financial stability. However, it's essential to strike a balance to maintain harmonious supplier relationships.

- Q.2 Should businesses aim for a high or low AP turnover ratio?

-

Q.2 Should businesses aim for a high or low AP turnover ratio?

Ideally, businesses should strive for a higher ratio, signifying efficient financial management. But it's crucial to avoid extremes to keep supplier relations intact. - Q.3 What's a standard accounts payable turnover?

-

A ratio between 4 and 6 is generally considered standard. However, industry benchmarks can vary.

- Q.4 How does the AP Turnover Ratio impact business relationships?

-

A high AP Turnover Ratio can enhance trust and foster better relationships with suppliers due to timely payments. Conversely, a low ratio might deter suppliers from offering favorable credit terms, potentially indicating financial challenges.