Financial reports are a key part of any successful business. They provide accurate and up-to-date insight into the financial state of your company and can help you to make informed decisions.

However, it can be difficult to create effective financial reports.

To help you out, here are six actionable financial reporting tips that you can use to bring in intelligence and make sure your reports are as informative and useful as possible.

What is Financial Reporting?

Finance reporting is the process of preparing and presenting financial information about an organization to its stakeholders. This includes but is not limited to shareholders, creditors, management, analysts, and regulators.

Financial reports can include balance sheets, cash flow statements, income statements, statements of changes in equity, footnotes, and other disclosures.

These reports provide vital information about an organization’s financial performance and condition so stakeholders can make sound decisions when investing in or lending to the entity.

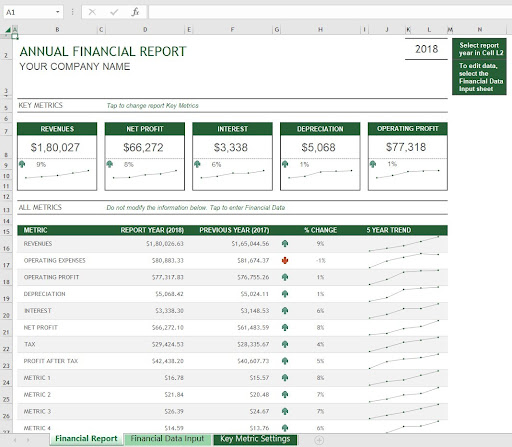

Here is a finance report sample for you – Annual financial report

Source: Microsoft

Finance reporting is necessary for companies for many reasons.

First, it provides a comprehensive overview of the financial performance of a business, providing investors, lenders, and other stakeholders with valuable information on how well the company is doing in comparison to its goals and objectives.

Secondly, through financial reporting, businesses can identify possible problem areas and take corrective action accordingly.

Additionally, accurate and timely financial reporting helps inform decision-making processes related to budgeting and other operational activities.

Finally, accurate financial reporting allows companies to fulfill their legal requirements regarding statements of financial position, income statements, balance sheets, and cash flow statements.

6 Actionable Tips to Make Financial Reporting Meaningful

Your finance and bookkeeping department or the agency you hire can use the following six tips to improve financial reporting for you.

1. Use Accounting Software

Accounting software are the most efficient tools to streamline the financial report generation process. They simplify complex calculations and record-keeping.

For example, accounting software like QuickBooks can help a company keep track of its expenses and revenues, as well as generate various financial reports such as balance sheets, income statements, and cash flow statements which ultimately can help managers make better-informed decisions.

2. Implement Automated Processes

Automation tools can reduce errors in the data involved in financial reporting when done correctly. For example, a company could use robotic process automation (RPA) to automatically enter data into their general ledgers from different sources.

This helps ensure that numbers are accurate and any discrepancies are quickly caught and fixed before they can affect any of the generated reports.

3 Assign responsibility for key areas

To ensure more accurate reporting, it’s important to properly assign responsibility for certain aspects of the financial reporting process, such as accounts receivable and accounts payable, to specific individuals or departments within your organization.

This ensures that each area is being taken care of by someone who understands it best and can identify potential issues before they arise or escalate.

It also helps reduce any confusion about who is accountable for what tasks so the work is completed on time.

4 Provide Adequate Training to Staff

Training is critical when it comes to the successful implementation of an effective financial reporting system within an organization.

Employees should have a good understanding of the fundamentals related to accounting practices like double-entry bookkeeping before being given any tasks related to generating financial reports or interpreting them for management purposes.

In addition, regular refresher courses during transition periods could go a long way toward maintaining consistency in generated results.

5 Establish a Clear Timeline and Review It Regularly

Proper timeline management needs to be established in order to complete various engagements associated with producing quality financial reports according to accepted standards within a given timeframe.

Such timelines need regular review so that bottlenecks due to external factors, such as information lag, etc., get addressed without having too much impact on delivery schedules and results at hand.

6 Analyze Reports Regularly and Compare Results

Financial analysts need to access the current period’s account information regularly: weaknesses/errors identified now should alert them if amendments have been made from period-to-period comparisons, which might mean that additional risk analysis needs to be performed.

Similarly, discrepancies might suggest new opportunities or sources for revenue growth warrants investigation.

Top 5 Financial Reporting Tools We Recommend for 2023

Being an accounting service provider, we keep testing several tools to get the best for our clients. Here are the top 5 tools our accountants recommend for 2023:

Xledger:

Xledger is a cloud-based financial management system for enterprises and mid-size businesses. It offers real-time financial intelligence, automation, and integration with other business systems, such as ERP, HR, payroll, and finance. It also offers customized reports for monitoring organizational performance.

Zoho Books:

Zoho Books is an accounting software that helps you simplify your inventory management, project billing, and expense tracking process. It provides powerful reporting and analytics capabilities that give insight into your financial operations.

QuickBooks:

QuickBooks is a comprehensive accounting solution that’s been available since 1983. It comes with built-in reporting functionality, allowing you to create custom reports on any aspect of your business quickly and efficiently.

FinancialForce Accounting:

Financial Force Accounting is an all-in-one cloud accounting suite that includes automated budgeting tools and dashboards for better forecasting accuracy and visibility into the health of your business activities in real time. It also allows you to generate flexible yet detailed reports of financial health while providing audit trail capability to ensure regulatory compliance.

Adaptive Insights:

Adaptive Insights is a cloud-based corporate performance management (CPM) suite designed to help finance teams build accurate plans and forecasts easily from within Microsoft Excel or other applications they frequently use, like Salesforce or NetSuite ERP Financials. This solution allows users to merge data from various sources for better insights about their organizational performance trends for more informed decision-making in the long run.

Are You Ready for 2023?

The new year will bring in more opportunities for financial efficiency and effectiveness. Make sure you are ready for the following trends in the financial reporting segment:

Increased Use of Automation and Artificial Intelligence (AI):

AI will play a greater role in automating financial reporting processes, providing more accuracy and speed than ever before.

Emphasis on Total Supplier Trustworthiness:

Companies will have to pay closer attention to the integrity and statements made by their suppliers to ensure compliance with the latest regulations.

Greater Focus on Data Analytics:

Companies will deploy advanced data analytics to get more insights into their financial performance, taking advantage of the wealth of data now available.

Greater Adoption of Cloud Reporting Systems:

Cloud-based solutions will be at the forefront of financial data management, allowing for global access to company information from any connected device.

Shifting Focus to Real-Time Financials:

Companies will move towards real-time financials for faster decision-making, improved accuracy, and decision tracking, as well as reduced costs from traditional processes such as audits.

The emergence of Predictive Analytics:

Predictive analytics tools for predicting accounting entries, asset obsolescence, and other matters will increasingly be deployed by companies for efficient planning and operations analysis.

Expansion of Integrated Reporting Tools:

With integrated reporting platforms becoming increasingly popular with companies, there is an expectation that this trend will grow in 2023, with more organizations adopting this method for viewing, understanding, and managing their finances better.